The Certainty of Death and Taxes

- January 24, 2025

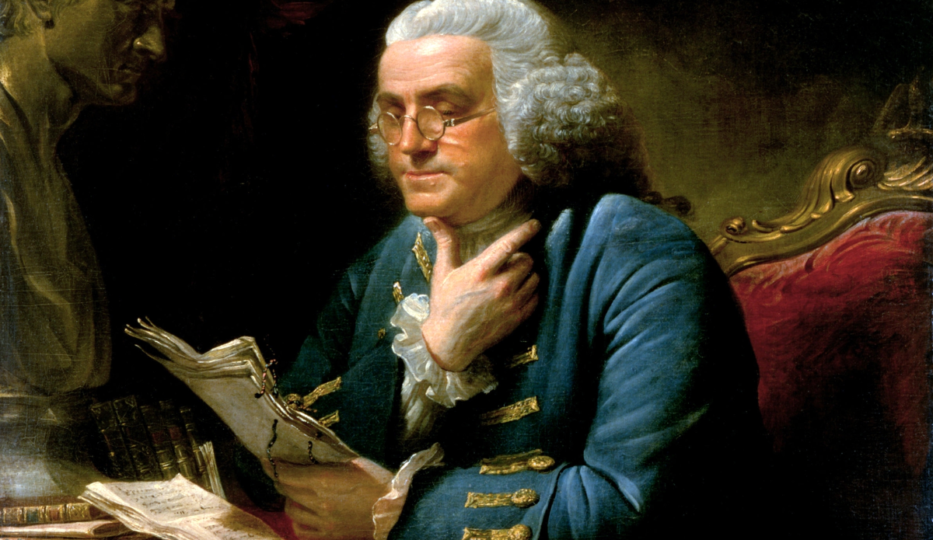

“In this world,” Benjamin Franklin famously wrote, “nothing can be said to be certain, except death and taxes.”

Doctor Franklin left out the certainty of government inefficiency.

My conviction that charitable giving is more efficient than government subsidization is one compelling reason why I joined DonorsTrust shortly after graduating college.

Since coming aboard, I’ve learned first-hand of the vast benefits that result from charitable giving—both for recipient charities as well as the giver.

In fact, research shows that giving really does have an endorphin effect, providing an “after-glow” that stimulates the pleasure center of the brain for having made an impact on other people’s lives. Our Giving Ventures podcast discusses that here. Give it a listen.

My Giving Journey

I remember that after-glow from my first charitable gift. I had met the founder of Basic Bible Guide (BBG), Daniel Kennedy, while working an event in Las Vegas. Daniel helped me understand BBG’s mission and impact on the lives of so many, leading me to support his cause through my donor-advised fund. I had just contributed to a cause dear to me and was delighted to learn how my donation was going to be used. The money I placed in my DAF long before my introduction to BBG was already set aside to support some sort of charity. All that was left for me to decide was which organization to give it to.

As a young giver, I’ve utilized the advantages of a donor-advised fund to streamline my humble efforts in being part of the change I want to see. I place my charitable dollars into the fund, immediately receive a single receipt for tax preparation, and then when I’m ready I advise DonorsTrust on the organizations I’d like to support.

More important than the simplicity, though, is the certainty. I’m certain that if something were to happen to me tomorrow, my charitable intent would be upheld. This is the primary reason DonorsTrust was founded: to protect and preserve the donor intent of conservative and liberty-minded givers.

Many young folks like myself do not prioritize setting up a will or thinking about their legacy planning. We twenty-somethings tend to think of ourselves as invincible and far too young to plan for our own mortality. But tomorrow is not promised.

DonorsTrust respects my values and shares my commitment to the principles of limited government and free markets, giving me certainty that my charitable intentions will be upheld even if I were to pass away.

Not All DAFs Are Created Equal

Many organizations offer donor-advised fund services, but not all of them share your values. Some providers have even denied gifts to conservative charities. Most commercial DAF providers advertise a broad, neutral approach to grant-making, stating they will honor reccomendations to any 501(c)(3) public charity in good standing with the IRS. But, after you give them your money, they may refuse to facilitate grant requests to conservative groups whose missions the commercial provider does not agree with.

DonorsTrust is different. Its mission and its principles are the embodiment of its promise. Created with a vision to protect donor intent, DonorsTrust continually strives forward in the promotion of liberty. While all DAF providers reserve the legal right to deny their clients’ gift recommendations, DonorsTrust exercises this right to preserve your intent rather than to push an outside agenda.

Your legacy is far too important to be left to chance—regardless of your age. Death and taxes are coming. Be certain that your legacy and charitable wishes are protected, both now and in the future.

The post The Certainty of Death and Taxes appeared first on DonorsTrust.